Category: Uncategorized

Has Covid really slowed down the pace of living…?

Check Instagram for the 3.5 million posts tagged theartofslowliving, or TikTok for 2 million views on #nesting videos. And type ‘how to maintain a slower…’ into Google and it’ll finish it for you – ‘…slower pace of life after lockdown.’ Plus 5 million answers…

All this ‘slow living’ talk is a reminder of the worldwide Hygge boom in 2016 – the Danish concept of cosiness and contentment. It was a big deal for a while (Dunelm probably agrees) but a few years later, it had all but disappeared as a trend. That is until it spiked again during the pandemic winters. You’ll also see booms for ‘mindfulness’ in January 2020, and ‘nesting’ in May 2020 and April 2021.

Gen Z students (AKA ‘Generation Savvy’) are far more fiscally mature and risk averse than Millennials were.

This year’s student has access to the tools (source 2) (peer-to-peer payments, crypto, challenger banking) and the nous (source 3) (side hustles, saving-overcredit, financially-driven choices) that their predecessors didn’t. Many were first exposed to the economy at a time when belts were being tightened – which has left its mark.

Half of all 18- to 22-year-olds in the US are now freelancing, (source 4) and Gen Z were the only generational cohort that spent less on Amazon in 2020. Literally everybody else in the world spent more. (source 5)

Source: UCAS 2022 report.

Other references:

3 – http://www.genzinsights.com/when-it-comes-to-money-weshould-all-act-more-like-gen-z

4 – https://influencermarketinghub.com/gen-z-spendinghabits-stats/#toc-3

5 – https://influencermarketinghub.com/gen-z-spendinghabits-stats/#toc-7

6 – https://www.savethestudent.org/money/studentbudgeting/what-do-students-spend-their-money-on.html

Insta culture…

The ambitious youth and retail therapy are in cahoots. They always have been, but Instagram has created a new culture of glitzy moments, where young people channel Kardashian lifestyles in miniature – all for a carefully curated grid photo.

Check #luxury and #luxurylifestyle and you’ll find 200 million posts, compared to just 7 million for the top ten #cheap hashtags combined.

UCAS 2022 student report

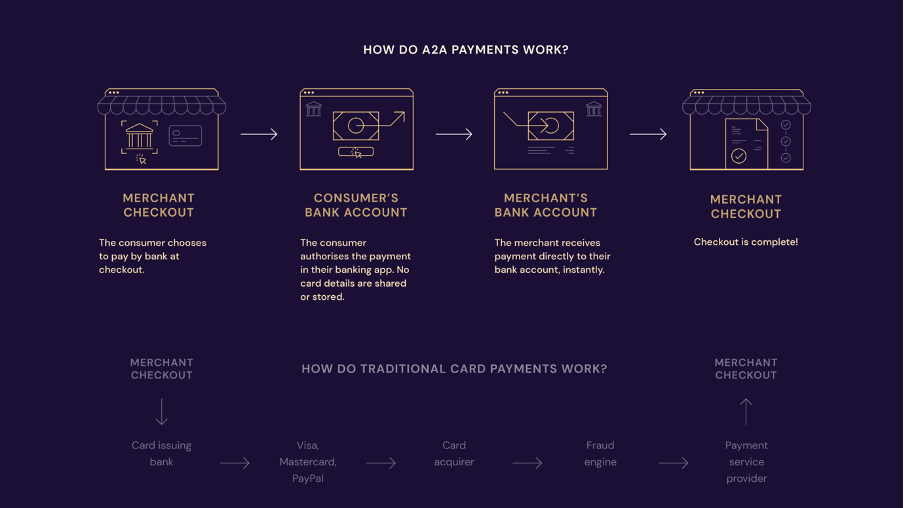

Why payments is being disrupted

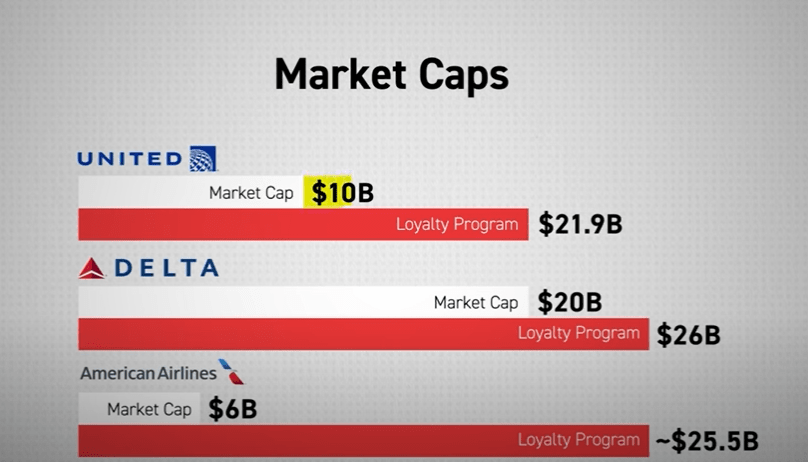

Airline loyalty programmes worth more than the companies themselves

The Layer Cake

Unbelievable

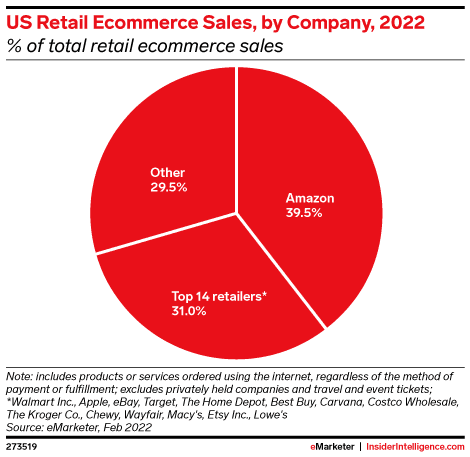

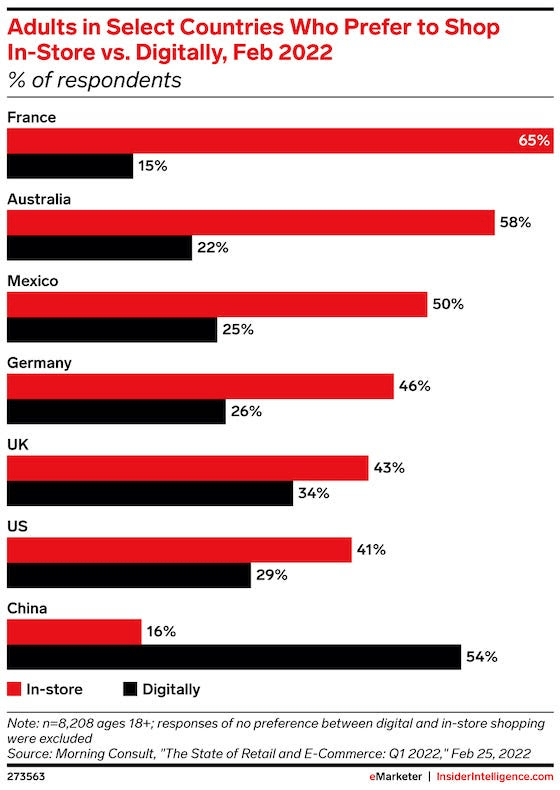

Beyond the chart: The competition just can’t keep up. This year, Amazon will pocket more than $400 billion of the country’s roughly $1 trillion in ecommerce sales. The retail giant will also rake in more than five times the digital sales of its closest rival, Walmart Inc., and see those sales grow by 14.6%, faster than the overall US ecommerce market, which will expand by 14.1%.

Insiderintelligence.com

Shopping behaviour

Angel investing is more about access than picking

There are three parts to angel investing: capital, access, and picking. Based on my experience, access is by far the most important part. If you have access, you can raise capital, and generally the most popular deals (i.e. the ones already discovered) also end up doing well. So picking becomes secondary.

Lenny

Conventional investing wisdom

Conventional investing wisdom tells us that VCs should pass on most deals they see. But our research indicates otherwise: At the seed stage, investors would increase their expected return by broadly indexing into every credible deal.

Abe Othman, Head of Data Science, AngelList Venture

Investing in startups

VCs like to pretend that they’re really smart, but ultimately it’s just math. A single 100x or 1,000x deal will return your fund. But it’s nearly impossible to know which deal that will be. The important thing is to invest in enough deals that could 100x+.

Julia Lipton, investor

Questions to ask each month

Source: Scalable Capital – 7 Questions every CEO should ask themselves every 30 days.

The Great Question: What is the one big thing that, if accomplished, would have the most significant impact in my business and render the need for other seemingly-important projects unnecessary? (NOTE: This question was inspired by the book, The One Thing)

The Gut-Punch Question: Why are our ideal prospects NOT buying from us? Is the offer unclear or unappealing? Are we trying to sell it to the wrong person?

The Intensity Question: In what areas of my life can I double my intensity? What about 10X?

The Procrastination Question: What are three things I haven’t started because I’m pursuing perfection? What are a few steps I could take today?

The Enemy Question: If I was competing against myself, what chinks in the armor would I exploit? How would I put a massive dent in my own brand?

The Pragmatic Question: Is our strategy not working because the strategy is bad, or is it not working because we are incapable of executing this strategy due to constraints we cannot resolve at this time?

The Zero-Base Question: Knowing what I know now, if I could start all over again, what changes would I make to my business model? What is preventing me from making those changes?

Universal lessons for fintechs

Curtesy of Rob Moffat from Balderton Capital:

- At seed/A stage, focus on how you can quickly demonstrate strong product-market fit with more modest amounts of capital.

- Unit economics really matter once you are at series B and beyond.

- Productivity of your product and engineering team matters. It is impossible to perfectly quantify the RoI of your product team but the exercise is worthwhile. What should the impact of your product roadmap for 2022 be on the bottom line, and how does this compare to your spending on product and engineering? Small teams can be extremely productive. Growing headcount by 200%+ each year puts enormous pressure on this

- Underwriting matters. We are already seeing this in insurance where low loss ratios in the pandemic (as people drove less and stayed at home more) have gone back to pre-pandemic levels, leading to prices hardening. In lending not so much yet (apart form a blip as stimulus payments in the US stopped) but it will probably come.

- As a result of this funding a debt book at a sensible price may be becoming more of a challenge

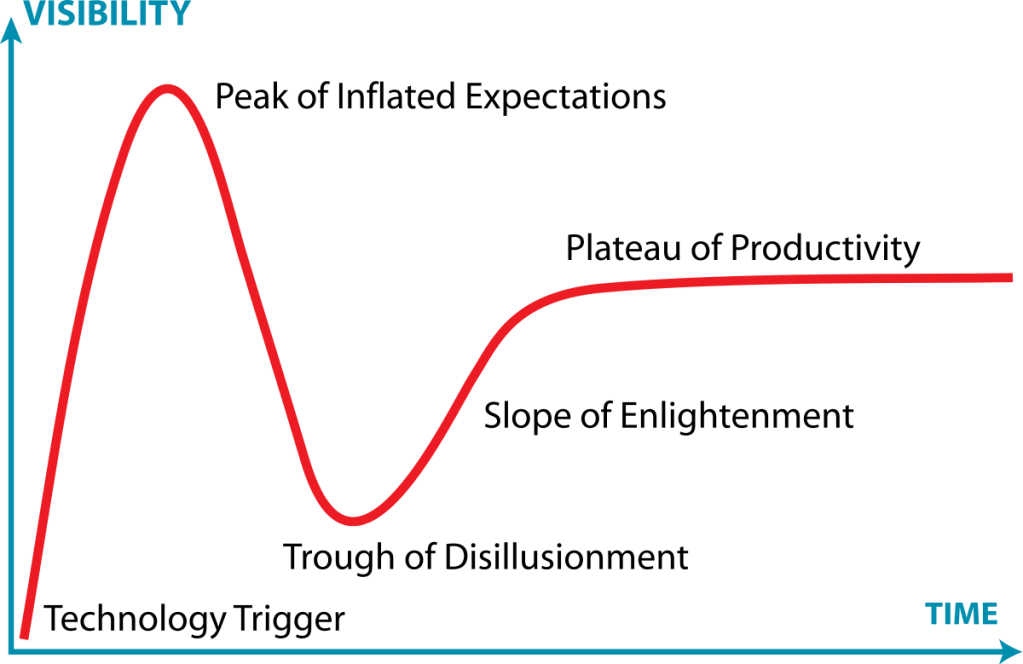

Typical adoption curve

Habit tracker

“Don’t break the chain” is a powerful mantra. Don’t break the chain of stashing money away in your savings account every month and you’ll build wealth and gain peace of mind. Don’t break the chain of meditation and you’ll gain focus and more control over your internal state. Don’t break the chain of reading every day and you will finish 20+ books per year. Don’t break the chain of practicing guitar every day and you’ll gain mastery faster than you’d expect.

Crypto accelerates international expansion

Crypto provides interesting advantages to marketplace startups

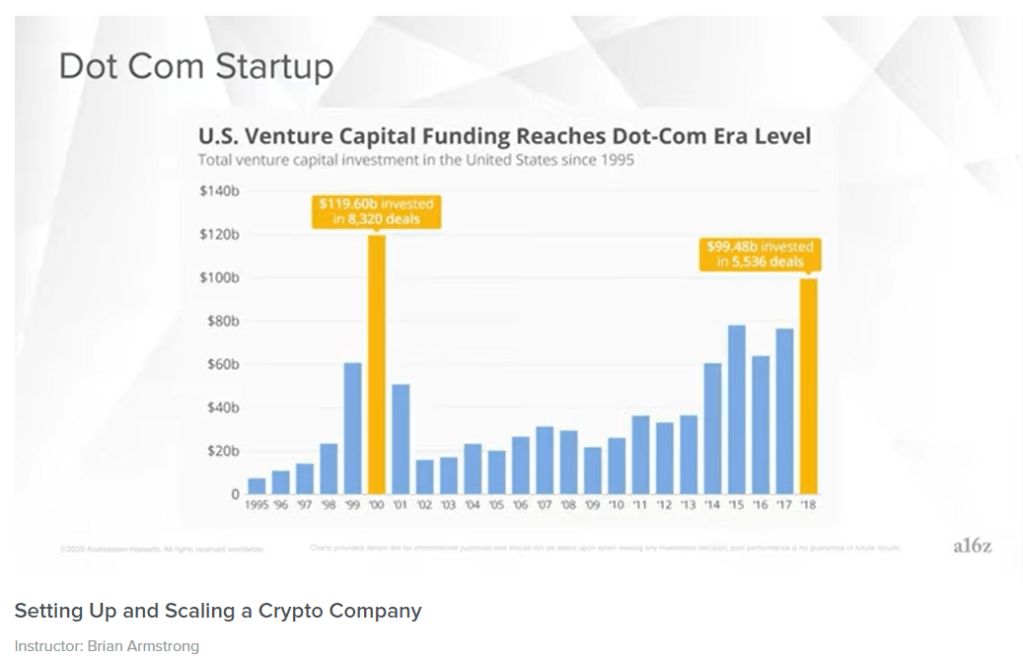

Dot Com Startup look back

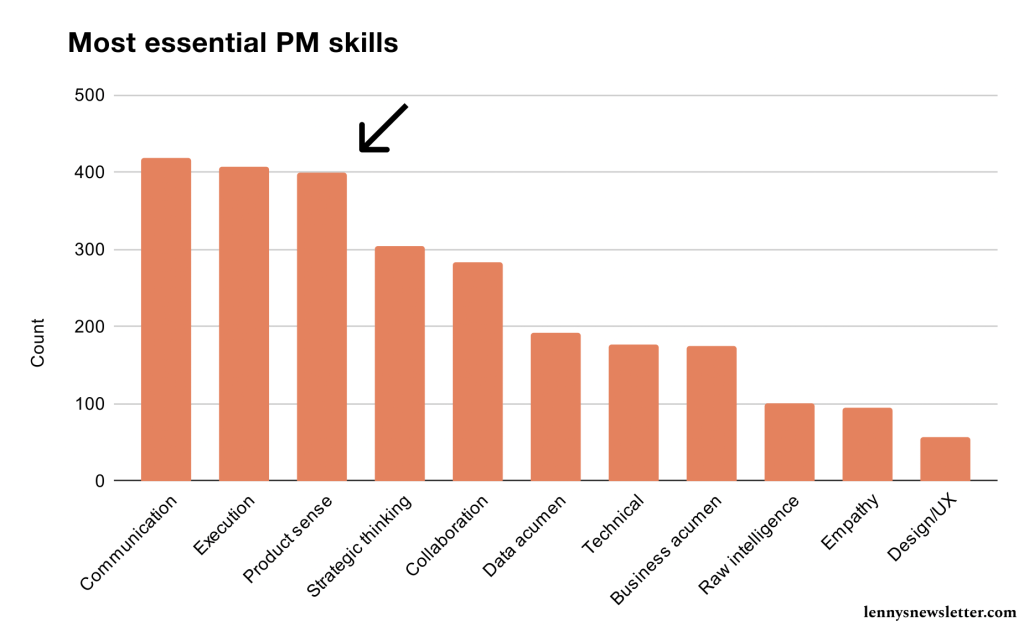

Essential skills

Listed as product management (PM) skills, but actually I think these are incredibly important in all areas of business.

You must be logged in to post a comment.